What is IC++ and how does it work?

As a merchant, you know accepting payments via credit card can come with added costs. Though credit cards make transactions easier and faster, they often have fees and complications associated with them.

Take the payment processing fee: In basic terms, you must pay the payment processor to move money from the buyer's account to your account – whether you use your own ecommerce platform or a third-party option like Shopify or Magento.

But how are those fees determined?

That's where interchange plus plus (IC++) pricing comes in. IC++ is a pricing model that payment processors use to calculate the fees associated with each transaction. Compared to flat or blended pricing, IC++ offers an added layer of transparency.

As a business owner, it's essential to understand the ins and outs of IC++ pricing to determine if it makes sense for your operation.

What is IC++?

IC++ or interchange plus plus is a popular pricing model that includes three processing fees:

- Interchange fee, charged by the bank that issues the credit card (e.g., DBS or Chase).

- Card network fees, charged by credit card network (e.g., Visa or Mastercard).

- Markup fee, charged by the payment processor (e.g., PayPal).

If you use the IC++ pricing model, these fees come out of each sale you make. For example, say a buyer pays $100 for your product. Here's what those IC++ fees may look like:

- Interchange fee: Chase bank earns 2% or $2.00.*

- Card network fees: Visa earns 0.5% or $0.50.*

- Markup fee: PayPal earns 1% or $1.00.*

As the merchant, you receive $100 - 2 - 0.5 - 1 = $96.50.

What's the difference between IC++ and blended pricing?

Blended or flat pricing is a common alternative to IC++ pricing.

With blended pricing, the payment processor charges an overall rate, such as 3.5%*, for each transaction – regardless of the card type, issuing bank, and other various factors. So instead of the merchant paying 2% to the bank, 0.5% to the credit card network and 1% to the payment processor, they pay the total 3.5% to the payment processor.

The payment processor then pays the bank and credit card network their percentages and keeps the rest as their margin.

So back to our example, if a buyer pays $100 for your product, you would see this fee:

Payment processor earns 3.5% or $3.50.

As the merchant, you receive $100 - 3.5 = $96.50.

In these examples, the net result is the same for each pricing model. However, in reality, the pricing model you choose can often impact how much you receive based on variables like the buyer's card type and processor's margin. Interchange fees can be different for personal vs. corporate cards, domestic vs. cross-border transactions, different payment methods and different transaction types.

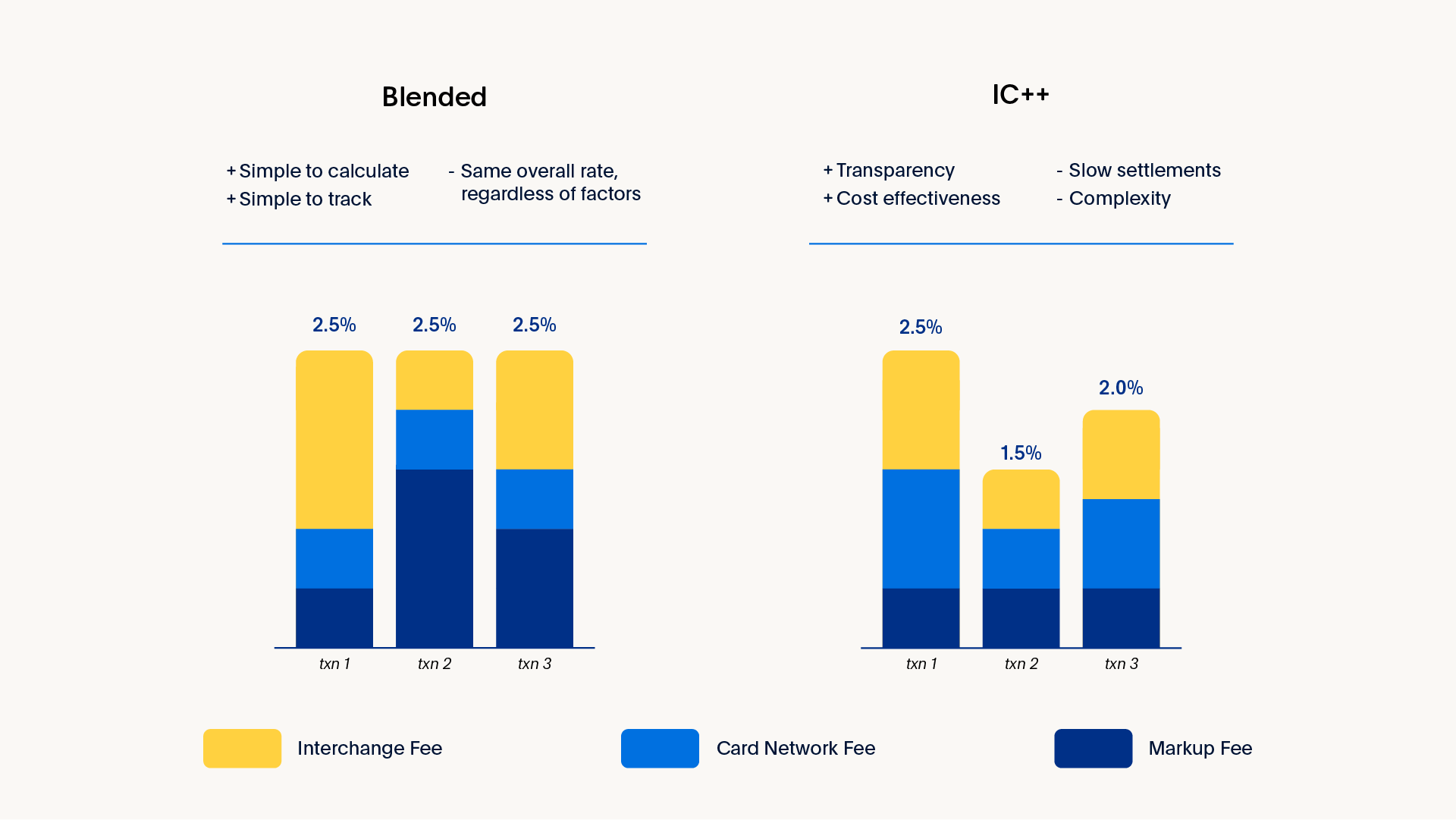

When it comes to comparing IC++ and blended pricing, blended pricing is simpler to calculate and keep track of, but IC++ is more transparent and potentially more cost-effective.

What are the pros and cons of IC++?

IC++ pricing has its own unique benefits and drawbacks.

The biggest pros of IC++ include:

- Transparency. As a merchant, you can clearly see each individual fee issued to different parties for each transaction and each type of transaction.

- Cost-effectiveness. With a transparent view of each fee, you can better control your finances.

Meanwhile, the potential downsides of IC++ include:

- Slow settlements. It sometimes takes two to three days for payment processors to receive the fee information from credit card networks and issuing banks. This causes a delay before transactions can be settled accurately. Typically, for gross settlements (see below), sales transactions are settled in near real-time but fee calculations may take a few days.

- Complexity. Settlements can be complicated, since more fees and transaction details are displayed on each report.

Gross settlement vs. Net settlement

- Gross settlement. Receive the full payment from each transaction up front and pay all processing fees later, typically at the end of the month or in the following month. Example: You receive $100 and pay $3.50 at the end of the month.

- Net settlement. Receive only your portion of each transaction, paying processing fees right away. Example: You receive $96.50.

Some payment processors offer a choice of gross or net settlement methods. Gross settlement is a good option for merchants who want to maximise immediate cash flow and delay fee payments. It allows you to make one collective payment at the end of the month instead of many small payments daily.

Does IC++ make sense for your business?

IC++ pricing is transparent and could potentially be cheaper, if you as a merchant follow best practices to keep the network and issuance cost low. IC++ pricing also provides an opportunity to optimise interchange fees due to the number of factors that can influence them. For example, some cards are eligible for Level 2 and Level 3 processing, which enables merchants to pass more information about a transaction to the issuer for better risk assessment. In return, merchants can potentially benefit from lower interchange rates and enhanced visibility into their corporate spending.

How to set up IC++ pricing with PayPal?

IC++ with gross settlement is offered to eligible merchants for receiving card payments (including wallets like Apple Pay and Google Pay) in PayPal Complete Payments. To be eligible for the IC++ pricing model, you’ll need to complete onboarding and set up Advanced Checkout to receive credit and debit card payments. You will then need to speak with your PayPal account manager to set up IC++ pricing for you.

When IC++ pricing with gross settlement is turned on, you’ll receive the full amount from each card payment1 at the time of transaction without paying for the card processing fee and interchange fee. You’ll receive an invoice once a month for the accumulative fees, and PayPal will auto-debit those fees from a bank account of your choice. You’ll also receive monthly reports that show a detailed breakdown of your costs.

To learn more about IC++ pricing provided by PayPal, contact our sales team at +65-6510-4541.

1 Fees for value added services are still deducted at the time of transaction.

* The fees quoted are for illustrative purposes only and are not representative of actual fees charged by the institutions named in the examples.